14 August 2019

By Maynard Paton

Results summary for Daejan (DJAN):

- These full-year figures set new records for revenue, up 9%, net asset value, up 7% and the dividend, up 3%.

- The 3.5% valuation gain was DJAN’s lowest since 2012 following the “uncertainty” caused by Brexit. Management remarks suggested current-year growth could slow further.

- A significant purchase in the States has lifted the proportion of US properties to 29% of the group’s estate.

- The accounts remain conservatively financed and the property valuations continue to appear prudent.

- The share price represents only 46% of net asset value — the lowest percentage for seven years. I continue to hold.

Contents

Event link and share data

Why I own DJAN

Results summary

Revenue, profit, dividend and net asset value

Investment properties

Cash flow and borrowings

Valuation

Event link and share data

Event: Preliminary results for the twelve months to 31 March 2019 published 23 July 2019.

Price: £55

Shares in issue: 16,295,357

Market capitalisation: £896m

Why I own DJAN

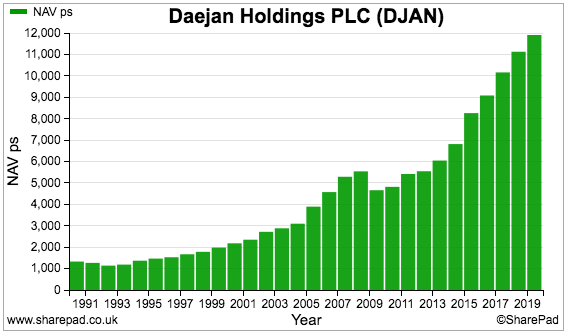

- Commercial and residential property landlord that boasts an illustrious, 40-year-plus history of net asset value and dividend advances.

- Board led by veteran family management that continues to control an aggregate 80%/£717m shareholding.

- Net asset value of £119 per share is more than double the recent share price.

Further reading: My DJAN Buy report |All my DJAN posts| DJAN website

Results summary

Revenue, profit, dividend and net asset value

- The positive first-half revenue and net asset value (NAV) progress revealed during November had already underpinned this set of record annual figures.

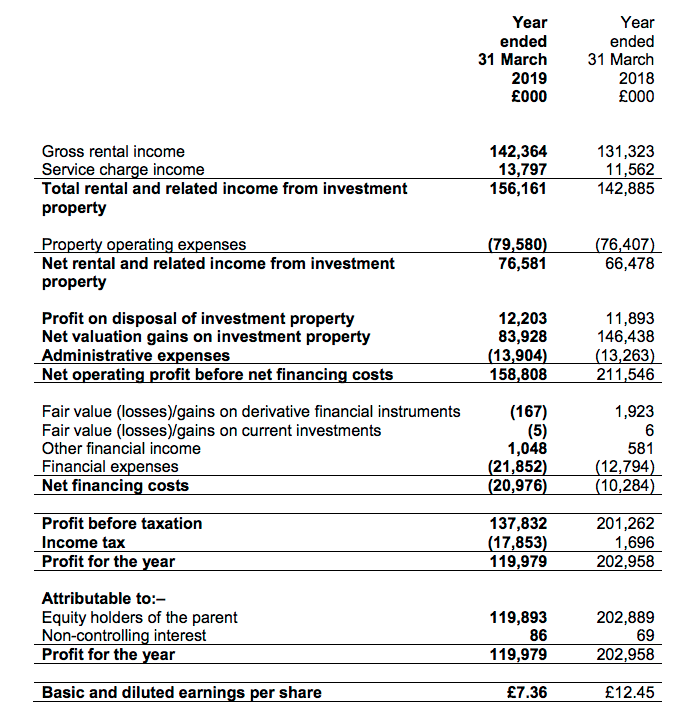

- For the full year, revenue gained 9%, NAV climbed 7% while the dividend was lifted 3%:

| Year to 31 March | 2015 | 2016 | 2017 | 2018 | 2019 |

| Net asset value (£k) | 1,345,818 | 1,480,025 | 1,655,715 | 1,812,902 | 1,940,354 |

| Net asset value per share (p) | 8,259 | 9,082 | 10,161 | 11,125 | 11,907 |

| Revenue (£k) | 128,976 | 138,197 | 140,738 | 142,885 | 156,161 |

| Operating profit (£k) | 47,114 | 55,148 | 52,241 | 53,215 | 62,677 |

| Profit on property disposal (£k) | 12,036 | 11,725 | 14,594 | 11,983 | 12,203 |

| Net valuation gain (£k) | 229,722 | 117,947 | 144,508 | 146,438 | 83,928 |

| Finance expense (£k) | (11,763) | (12,692) | (13,532) | (12,794) | (21,852) |

| Other items (£k) | 430 | 1,114 | 585 | 2,510 | 876 |

| Pre-tax profit (£k) | 277,539 | 173,242 | 198,396 | 201,262 | 137,832 |

| Earnings per share (p) | 1,395 | 877 | 993 | 1,245 | 736 |

| Dividend per share (p) | 88 | 93 | 98 | 103 | 106 |

- For the first time since 2016, the second half showed greater revenue from both DJAN’s UK and US operations than during the first half:

| H1 2018 | H2 2018 | FY 2018 | H1 2019 | H2 2019 | FY 2019 | ||

| UK revenue (£k) | 45,602 | 46,793 | 92,395 | 47,822 | 52,542 | 100,364 | |

| US revenue (£k) | 25,668 | 24,822 | 50,490 | 26,144 | 29,653 | 55,797 | |

| Total revenue (£k) | 71,270 | 71,615 | 142,885 | 73,966 | 82,195 | 156,161 | |

| Valuation gain (£k) | 29,536 | 116,902 | 146,438 | 32,521 | 51,407 | 83,928 |

- Full-year rental income advanced a useful 8% to £142m. The terse results RNS only revealed: “The [rental income] increase has principally been driven in the UK by the completion of the Travelodge hotel and other developments. In the USA the main factor has been the acquisition of three new residential properties at a total cost of $98 million.”

- At least the annual report (see below) subsequently gave a few more details about the sources of the higher rental income:

- the completion of a 395-bedroom London Travelodge hotel;

- the conversion of a Brighton office block into 63 flats;

- the purchase of 552 apartments in Florida, and;

- the purchase of 62 apartments in New York.

- Expenses did not climb as fast as revenue, leaving full-year operating profit at a record £63m. The 40% operating margin for 2019 was the highest since 2003 (41%).

- Earnings were bolstered by the usual sale of lease extensions (accounted for as ‘profit on property disposals’) and an £84m valuation gain.

- The £84m valuation gain was DJAN’s lowest since 2013 (£83m) and represented a 3.5% increase on the £2.4b year-start value of the group’s investment properties. The 3.5% increase was the lowest since 2012 (1.3%).

- DJAN claimed “uncertainty created by Brexit and political risk has led to a reduction of foreign investment, which in turn has had a depressive effect on some commercial and residential values in central London. So far as residential property is concerned, this was offset by modest gains in value in outer London, so that Greater London as a whole showed [valuation] growth of 3.9%”.

- Some 70% of DJAN’s UK assets by value (£1,280m of £1,804m) are located somewhere in London.

- The all-round progress added a net £127m to the balance sheet and lifted NAV to £119 per share.

- The results extended DJAN’s illustrious long-term record. After the current chairman took charge during 1980, NAV has since soared 87-fold (+12% average), the dividend has since expanded 29-fold (+9% average) while rental and other income has since multiplied 16-fold (+7% average):

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Investment properties

- The $98m purchase of three US apartment buildings left DJAN’s US properties representing their highest-ever proportion of the group’s total estate — 29% (£750m of £2,555m).

- The weaker GBP assisted the valuation of the US properties. GBP:USD fell from 1.40 to 1.30 during the year and produced a £45m (£2.78 per share) foreign-exchange translation gain.

- DJAN’s US properties also benefited from a £32m valuation gain — equivalent to a 5.1% improvement, albeit the lowest uplift since 2011 (3.5%).

- Including DJAN’s other US assets and the associated borrowings, US net property assets now represent 21% of the group’s capital.

- Translated at the recent GBP: USD 1.21, DJAN’s US net property assets would increase by £30m or £1.82 per share.

- The $98m purchase of three US apartment buildings has meant residential properties (UK and US) now represent their highest-ever proportion of the group’s overall estate — 57% (£1,465m of £2,555m):

| Year to 31 March | 2015 | 2016 | 2017 | 2018 | 2019 |

| UK property valuation | |||||

| Commercial -- Greater London (£k) | 468,400 | 512,627 | 524,615 | 548,284 | 549,761 |

| Commercial -- other (£k) | 381,700 | 391,373 | 426,450 | 468,035 | 436,634 |

| Residential -- Greater London (£k) | 538,000 | 577,796 | 659,160 | 702,488 | 729,924 |

| Residential -- other (£k) | 56,400 | 51,019 | 58,405 | 80,526 | 87,879 |

| US property valuation | |||||

| Commercial (£k) | 52,700 | 61,162 | 84,568 | 87,062 | 103,036 |

| Residential (£k) | 365,400 | 426,710 | 517,898 | 505,343 | 647,432 |

| Total (£k)* | 1,862,600 | 2,020,687 | 2,271,096 | 2,391,738 | 2,554,666 |

(*excludes lease incentives)

- UK properties enjoyed a £52m/2.9% valuation uplift — the lowest since 2012.

- The benefits of ‘yield compression’ — whereby property valuations are marked higher as investors decide to pay more for rental incomes — may now have stalled:

| Year to 31 March | 2015 | 2016 | 2017 | 2018 | 2019 |

| Rental income (£k) | 112,847 | 117,733 | 125,522 | 131,323 | 142,364 |

| Service charge income (£k) | 16,129 | 20,464 | 15,216 | 11,562 | 13,797 |

| Total revenue (£k) | 128,976 | 138,197 | 140,738 | 142,885 | 156,161 |

| Investment property (£k) | 1,855,230 | 2,009,361 | 2,256,800 | 2,373,184 | 2,532,518 |

| Rental income/Average investment property (%) | 6.6 | 6.1 | 5.9 | 5.7 | 5.8 |

- Rental income as a proportion of the average value of the property estate increased a fraction to 5.8%. DJAN’s ‘valuation yield’ had compressed from 7.5% to 5.7% between 2012 and 2018.

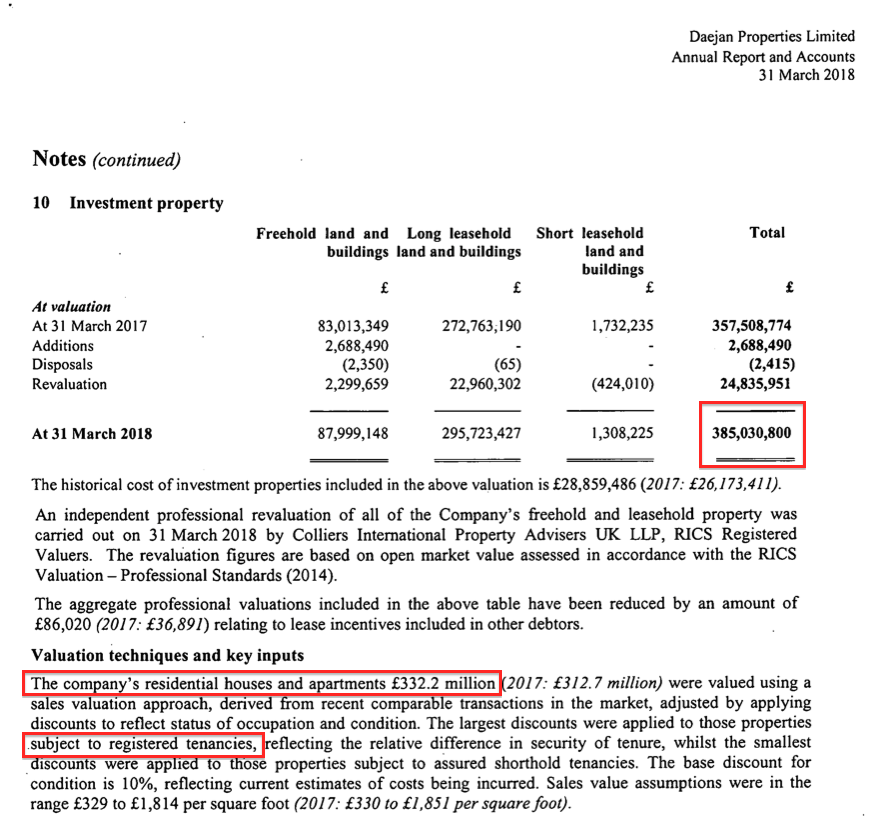

- Many of DJAN’s residential properties are regulated tenancies — the type owned by fellow portfolio member Mountview Estates — and therefore collect little rent in comparison to their value.

- Group subsidiary Daejan Properties Limited provides a good example. For 2018, this subsidiary reported rent of £12.4m and carried investment properties that averaged a £371m value during the year. The subsidiary’s rental yield was therefore 3.3%.

- Other UK properties must therefore sport higher yields, which I would like to think suggests the balance-sheet valuations are prudent. I calculate DJAN’s UK commercial properties are valued at an average 6.5% rental yield. The annual report small-print (point 12) claims some sites are valued at yields above 30%.

Cash flow and borrowings

- DJAN spent an enormous £108m buying new sites and developing old properties during 2019:

| Year to 31 March | 2015 | 2016 | 2017 | 2018 | 2019 |

| Operating profit (£k) | 47,114 | 55,148 | 52,241 | 53,215 | 62,677 |

| Acquisition/development of investment property (£k) | (43,460) | (26,939) | (27,726) | (39,424) | (108,463) |

| Proceeds from sale of investment property (£k) | 16,772 | 12,807 | 18,242 | 16,085 | 16,098 |

| Working-capital movement (£k) | (5,909)* | 6,381* | (13,088) | 3,265 | 4,948 |

(*estimated)

- The £108m was the largest sum spent enhancing the estate during any year for at least two decades.

- The significant expenditure meant gross debt increased by £81m to £431m and net debt increased by £83m to £335m.

- Nonetheless, net debt is equivalent to only 13% of the full property portfolio — a very conservative level of gearing:

| Year to 31 March | 2015 | 2016 | 2017 | 2018 | 2019 |

| Net debt (£k) | (252,117) | (237,065) | (268,256) | (251,707) | (334,859) |

| Investment property (£k) | 1,855,230 | 2,009,361 | 2,256,800 | 2,373,184 | 2,532,518 |

| Net debt/Investment property (%) | (13.6) | (11.8) | (11.9) | (10.6) | (13.2) |

- Bank interest represented a reasonable 3.9% of the average debt employed during the year. Operating profit covered net interest payments a respectable 4.1 times:

| Year to 31 March | 2015 | 2015 | 2016 | 2018 | 2019 |

| Operating profit (£k) | 47,114 | 55,148 | 52,241 | 53,215 | 62,677 |

| Interest expense (£k) | (11,751) | (12,683) | (13,519) | (12,615) | (15,313) |

| Average debt (£k) | (297,995) | (313,252) | (337,252) | (351,499) | (390,607) |

| Operating profit/Interest expense (x) | 4.01 | 4.35 | 3.86 | 4.22 | 4.09 |

| Interest expense/Average debt (%) | 3.9 | 4.0 | 4.0 | 3.6 | 3.9 |

- Net debt could be reduced during the current year should DJAN sell a £71m London property that is “held for sale” on the balance sheet. DJAN claimed the disposal was “highly probable”. The purchaser is Unite Group.

Valuation

- DJAN’s outlook was very measured.

- Brexit, “headwinds in the retail market” and the chance of “further adverse [letting] regulations” were cited as reasons why the UK property market may in the near-term produce “only modest valuation gains at best”.

- Management added “the risk of recession in the UK from both internal and external influences appears to be growing”.

- In the US, “the outlook is still for solid growth although uncertainties have increased… the immediate outlook is less positive than in recent years.”

- DJAN noted: “New rent regulation laws in New York state that came into effect on 1 July 2019 are expected to depress New York residential values in the coming year”. The “majority” of DJAN’s US residential properties are located in New York.

- This time last year the chairman remained confident: “We are always long term in our approach and I remain confident that the pursuit of our tried and tested strategy will ensure that the Group continues to progress.”

- Now the chairman is referring to possible storms: “[W]e believe that by the pursuit of our well proven strategy of prudence and risk minimisation coupled with the conservation of cash and bank resources we will be well placed to ride out any storms which may lie ahead.”

- A major project that could support growth — the development of a block of properties at the eastern end of Oxford Street, London — has been deferred by at least a year. Construction work is now “unlikely to commence” before 2021 following an opportunity to “improve and extend” the site.

- The upshot is not to expect NAV fireworks for 2020: “In the immediate future we are unlikely to experience the rate of growth in net asset value that we have enjoyed in recent years.”

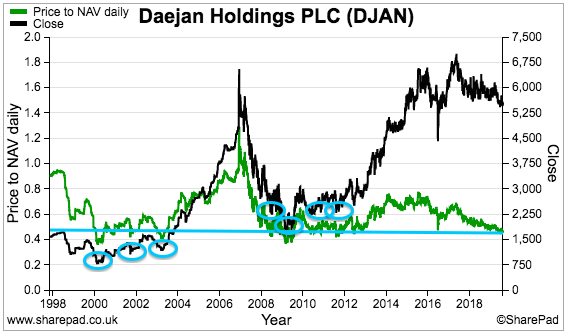

- The subdued management remarks explain why the share price has effectively gone nowhere during the last five years — and trade at only 46% of the group’s NAV.

- Other, long-standing, reasons for DJAN’s hefty discount include the board’s 80% family shareholding, the absence of any takeover possibilities, management’s unconventional corporate governance and a lack of City engagement.

- The emerging debate about executive diversity has not helped market sentiment either.

- DJAN has never employed a female director — and the board’s “strictly Orthodox background and beliefs” are unlikely to prompt a change any time soon. Diversity campaigners are not impressed.

- The board’s old-fashioned ways — which include not moving the previous chairman’s armchair for 40 years — have nonetheless served long-haul investors very well.

- I remain hopeful that, one day, the discount to book will permanently narrow as the group’s performance and size become too difficult for the wider stock market to ignore.

- Until then, the present discount does appear greater than usual.

- The SharePad chart below compares the share price (the black line) with the price to NAV (the green line):

- Investing at the current 46% price to NAV — that is, when the green line falls to, or dips beneath, the straight blue line — has generally worked out well for investors. (The blue circles highlight previous buying opportunities at a 46% price to NAV).

- Only during two market extremes — the ‘old-economy’ sell-off of 2000 and the banking-crash lows of 2009 — has the price to book ever dropped below 40% within the last 20 years.

- Another way of looking at DJAN’s value is from a return on equity standpoint.

- During recent ten-year periods, DJAN has earned at least 7.6% a year from its asset base:

| 10yrs to 2015 | 10yrs to 2016 | 10yrs to 2017 | 10yrs to 2018 | 10yrs to 2019 | |

| Start NAV (£) | 38.94 | 45.74 | 52.88 | 55.40 | 46.60 |

| End NAV (£) | 82.59 | 90.82 | 101.61 | 111.25 | 109.07 |

| Dividends accumulated (£) | 7.55 | 7.83 | 8.11 | 8.41 | 8.74 |

| Total return (£) | 51.20 | 52.91 | 56.84 | 64.26 | 81.22 |

| Total return/Start NAV (CAGR %) | 8.8 | 8.0 | 7.6 | 8.0 | 10.6 |

- Assuming DJAN can earn an average of, say, 7.5% a year from its £119 per share asset base, typical annual earnings could be £8.93 per share — represented by a mix of rental profit and valuation gains.

- In theory at least, enjoying £8.93 per share a year from a £55 entry price is equivalent to a very worthwhile 16% annual return.

- However, perhaps a business that earns a return on equity of only 7.5% deserves a modest rating and should be valued at a discount.

- The trailing 106p per share dividend meanwhile supports a modest 1.9% income.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Disclosure: Maynard owns shares in Daejan.

Daejan (DJAN)

Publication of 2019 annual report

Here are the points of interest.

1) Outlook

The full management outlook comments felt more pessimistic than those contained within 2018’s annual report:

2) Operating risks

Underlining management’s caution, “conservation of cash and bank facilities” has been added as a mitigation against economic risks:

I see “such as we presently face” has been added to the same text from last year to emphasise management’s pessimism:

A new separate risk for the retail sector has been introduced:

I note the word “will” in the line “downward pressure… will continue”

3) Oxford Street, London

This project was first mentioned in the 2015 annual report and I guess the subsequent progress underlines how long property development can take:

I am hopeful the final development will create a not-insignificant NAV improvement.

4) Director pay

The Freshwater brothers enjoyed a £50k pay rise and now earn £1.25m each:

The chairman’s salary has enjoyed a 7.5% CAGR over 5 years, 6.0% over 10 years and 6.5% over 20 years. In comparison, shareholders’ income through the dividend has grown at a 5.3% CAGR over 5 years, 3.8% over 10 years and 4.5% over 20 years.

Executive pay is therefore out-running dividend growth, which is not ideal. I suppose the generous salaries could be excused given the board’s extended track record of reliable NAV and dividend increases. At least DJAN does not operate any option or director-bonus schemes.

The AGM voting was broadly the same as the year before:

The 624k votes against are equivalent to c20% of the 3.3m shares (20%) that are not controlled by the board’s family interest.

5) Gender diversity

The diversity campaigners (see my blog post above) have had an impact on the annual report.

This small-print is new:

And so is this:

So a female director could indeed be considered — if an opening for a new director appears. (I suspect an opening for a new director will not appear soon).

6) Audit materiality and risks

No issues here.

Audit materiality remains (the standard) 1% of gross assets and £3.2m, equivalent to (the standard) 5% of operating profit. 100% of the group was audited, too.

Levels of subsidiary materiality were left broadly unchanged and continue to require the auditor to dig reasonably deep:

Two new audit risks were disclosed.

The new Brexit risk is described as having “unprecedented” levels of uncertainty:

DJAN’s chairman has been a board member since 1971, and I suspect has witnessed plenty of “unprecedented” uncertainties during his directorship tenure.

I am pleased the auditor found nothing untoward when evaluating the new ‘going concern’ risk:

One risk that has decreased is tax:

DJAN has agreed to a settlement with HMRC (see point 10 below)

I did not realise DJAN had employed the same auditor for 60 years:

A tender process could be held soon.

7) Accounting changes

No issues here:

The effect (if any) of IFRS 16 — the new rules for lease accounting — on Daejan will be interesting to see, given the group is “primarily a lessor, whereas the standard primarily affects lessees.”

8) Service charge

DJAN’s revenue can be influenced by service-charge income:

For 2019, such income represented £14m/9% of revenue.

From a previous discussion, I understand this income does not have a material effect on profit.

9) Employees

The number of full-time equivalent employees paid by DJAN to the property-service companies controlled by management (see point 19 below) has impressively remained in the 139-149 range seen since 2005:

The average cost of such employees is now £51k each — up £2k on 2018 and up £9k on 2014.

10) Tax

The small-print revealed DJAN paid £6.4m interest on overdue taxes:

Further small-print revealed DJAN has agreed to pay HMRC overdue taxes of £37m:

The 2018 small-print said any settlement could be between £23m and £52m.

11) Investment properties

The majority of properties remain freehold:

12) Valuations

The following table contains the data that led me to calculate the group’s UK commercial properties are valued at a 6.5% average yield:

Some units are valued at a 36% rental yield.

Shopping centres have lost some value, but care homes — bought in 2008/9 for £33m from a troubled owner — may now be operating well following years of difficulties:

Leisure & Services properties — which include the Travelodge hotel and the revitalised care homes — now carry a £181m value, a £40m or so improvement on 2018 and almost a £100m improvement on 2017:

UK retail properties declined by a surprisingly small £12m to £406m. Back in 2009 the value was £208m.

The US valuations are now performed by a single valuer, after Joseph J. Blake & Associates was dropped:

13) Held for sale assets

DJAN has introduced a new ‘held for sale’ classification to accommodate the “highly probable” sale of a particularly significant property:

The sale should go through before the end of December.

14) Cash

I keep overlooking that DJAN carries tenant deposits on its balance sheet, which should not be deemed as company cash and therefore not included in my net debt calculations:

15) Loans and interest

The majority of loans remain denominated in USD and are repayable after 5 years:

The new fixed-rate mortgages taken on incur interest between 4% and 5%:

I see the weighted-average interest rate for GBP fixed-rate borrowings fell notably. Approximately 83% of DJAN’s loans are fixed rate, with the balance variable rate.

16) Foreign-exchange impact

£36.2m is equivalent to £2.22 per share.

17) Future lease income

I am not entirely sure whether this note is truly significant:

The numbers indicate DJAN’s tenants have agreed to pay the group at least £605m of future rent — an £156m increase during the year and presumably due in part to the Travelodge hotel completion.

The £605m figure is a new high — the figure previously bounced between £550m and £392m between 2010 and 2018. I have not yet determined how rental income can increase over time while the level of committed future rents can bounce up and down.

18) Trade receivables

Nothing too dramatic here:

Rent and service-charge receivables of £43m represent 27% of revenue — no improvement on 2018 and still above the 20% or so seen up to 2015. DJAN’s cash flow has shown no obvious debtor-collection issues.

Rent and service-charge receivable impairments of £8m are notably the lowest since 2014 and, at 15%, are the lowest proportion of gross rent and service-charge receivables since the figures were first disclosed during 2010.

19) Related party transaction

DJAN was charged £1m less by the board’s property-management businesses:

I have previously investigated these property-management businesses and the transactions all appear above board.

20) Alternative performance measures

These measures are new for 2019. Nothing too radical has been included.

This alternative-performance table is handy, as the group’s property movements — and underlying valuation gain — are neatly summarised:

Maynard

Daejan (DJAN)

AGM attendance

I attended yesterday’s DJAN AGM. The following is my best recollection of what was said during the chairman’s statement, follow-up Q&A and post-meeting chit-chat (mostly paraphrased). No proof of share ownership was needed to attend.

All board members were present and executive chairman Benzion Freshwater (BF) made a short statement before answering every question during the subsequent Q&A. None of the other directors spoke. The formal business of the AGM was conducted behind the scenes following the Q&A.

The meeting attracted 30 or so attendees — a mix of family/veteran shareholders, advisors and ordinary investors. About 8-10 different (ordinary) investors asked questions.

It was a pleasure to meet Philip who reads my blog and who approached me to say hello.

————-

BF’s opening statement mostly recapped DJAN’s progress for 2019.

But he did admit the group was “cautious to committing to new developments” and that fewer developments were currently underway than the year before.

Notably, BF said the first quarter (April-June) had suffered “some effect of the economic uncertainty“, with an “increase in vacancies and a decrease in rent roll“. BF did not make clear whether those changes were felt throughout the group or just within particular areas (e.g. UK retail).

BF added that that he was hopeful DJAN would “pull through the political and economic uncertainty with the minimum of damage“.

On to the Q&A:

Q: Boardroom diversity — shouldn’t the board now appoint a female director?

A: BF referred to the annual report and read out the following snippets:

BF added that if he was a woman, he would be “offended if he was appointed simply because of being female“.

Q: Proposed regulation of ground rents?

A:“Not a major issue”.

Q: New York rent controls?

A:“Unfortunate for us”

Q: Labour party anti-landlord measures?

A: “Just have to face it, if and when it happens”

Q: New Travelodge hotel in London — a lot of money has been spent on a building for what could be a sub-standard tenant… at least judging by the Travelodge hotel in Southend?

A: BF said the new Travelodge hotel enjoys a 30-year lease term. The group spent a lot of time and effort considering the development and tenant, and the rent provides a “good return”. The hotel is Travelodge’s “flagship” site and Travelodge “will look after it”. The market value of the site could be greater if — and I think I understood this correctly — a different operator took control of the hotel.

Q: Dwindling share price?

A: “Stock market values are not in our control”. (Another shareholder said he was “delighted the price has come down as it presents a buying opportunity”.)

Q: A (female) shareholder (perhaps connected to the board in some way) said DJAN was “deliciously un-PC” and wished to invest in other public companies with similar “un-PC” directors. She then joked she had offered to join the board.

Q: Who are the catastrophe-risk insurers (see page 10 of the annual report)?

A: Numerous insurers used. “Different risk, different insurer”.

Q: $98m spent on US properties last year — a deliberate shift to invest more in the US?

A: Yes, the US offers more opportunities, less regulation, and DJAN is likely to spend more there in the years to come. US property returns are likely to be greater than those produced in the UK, too.

Q: REIT status?

A: The board has considered REIT status, but concluded becoming a REIT was not suitable for two reasons: i) the Freshwater family would have to reduce its c80% shareholding substantially, and; ii) residential property does not “fit well” with the REIT rules, which are designed primarily for commercial property owners.

Q: Possibility of share buybacks?

A: The Freshwater family already own c80% and any buybacks would risk losing the group’s stock market quote — which the board “does not think is a good idea”.

Q: How is the dividend set?

A: Board looks at cash income (i.e. excluding valuation gains) and carefully measures the income needs of the business (to fund new developments). The plan is to “gradually increase the dividend year by year”.

Q: Annual report says “parades of local shops… have not suffered in the same way [as the high street]” — how much exposure does the group have to such sites and how have they avoided the problems?

A: No valuation figure was given but the local shops have local tenants who “do not pay fancy rents”. BF implied local shopkeepers tend not to take the same liability risks as “major [retail] multiples” that have fallen foul of the Internet/high rents etc.

Q: Possibility of investing in Europe?

A: The group did buy in Holland many years ago, did well and then got out, but now does not want to go back to the “casino table”. Management does not know the markets well enough — different laws, etc. The directors understand the US well, and prefer to operate within areas in which “they know what they are doing.”

Q: Valuation of regulated tenanted properties and average tenant age?

A: Regulated tenanted properties represent a “small proportion” of the residential portfolio. Management did not know the average age of the tenant — age is not something that the group would like to ask its tenants. The group has not purchased many units of this type of late.

(Some post-meeting chit-chat revealed the group owns 300-400 regulated tenancies, and a “pretty common” phenomenon within this niche sector is occupiers breaking the terms of their agreement — when the genuine tenant has died or has moved out, somebody else could keep paying the rent to retain the cut-price cost of the property. On paper, the average age of tenants “could be 120”. DJAN investigates each property one by one in order to unearth tenancy contraventions. Regulated properties are valued at 60% of fair market value in the accounts (for comparison, Mountview Estates buys at 75%). Average age of regulated tenancy tenants at Grainger was 76 at the end of 2017:)

Q: Oxford Street development cost and projected return?

A: Cost so far is £85m with a further £11m to go. “Won’t lose money” on the project. BF referred to “thin margins” and “less bullish” valuation multiples to avoid citing a possible valuation for the project post-completion. Hurdle rate for new developments is 15%, but that target is “not always met”.

Q: Threat of delisting?

A: According to the post-meeting chit-chat, the board apparently likes the “discipline of being a public company”. Going private has been discussed, but the Freshwater family “don’t have the appetite” to pay a premium to buy out other shareholders. The banks apparently like the transparency the listing gives, too.

Summary:

A useful meeting overall, although nothing too earth-shattering was revealed. I was pleased the chairman was very responsive to questions — DJAN’s corporate governance suggests the directors do not want to talk to anyone, and that view has not been helped by the ‘diversity’ media coverage.

One interesting aside is BF’s mobile phone rang during the Q&A. Perhaps the board’s old-fashioned ways are gradually being chipped away.

Maynard

this was very helpful Maynard

Thank you for attending and sharing with us. I remember an aged and long dead relative of mine bought shares in Daejan in the 1960s for 6s3p. Unfortunately I paid a lot more for mine and it is a loss maker at the moment but I am very patient

m

Thanks Max. Glad you found it useful.

Maynard

Just read your AGM report. Thanks for an excellent review of what was said, and what was left unsaid, which was very useful. One concern about this company for me is the shabbiness of some of their properties. Freshwater own a block of flats opposite Hampton Court station, close to where I live, and they have long looked like they needed attention. As a non property expert, it would seem a prime site – across the road from a station (30 mins to Waterloo) and just across the river from Hampton Court Palace. A bit more investment and the flats might attract higher value tenants. Thanks again for taking the time to explain your investment thinking.

Hi Bill,

Thanks for the comment. I don’t know whether the block includes regulated-tenancy flats, which tend not to looked after by landlords as much as standard-rented properties. I should add that an AGM question (omitted from my notes) did cover a particular development and renovation — not the block you mention — so perhaps other sites could be due more attention. I would like to think such renovations could indeed attract higher value tenants and in time higher book valuations.

Maynard